Charge of GST

Section of CGST Act

Section 9 : Levy and Collection

Section 10 : Composite Levy

(2) The central tax on the supply of petroleum crude, high speed diesel, motor spirit (commonly known as petrol), natural gas and aviation turbine fuel shall be levied with effect from such date as may be notified by the Government on the recommendations of the Council.

(3) The Government may, on the recommendations of the Council, by notification, specify categories of supply of goods or services or both, the tax on which shall be paid on reverse charge basis by the recipient of such goods or services or both and all the provisions of this Act shall apply to such recipient as if he is the person liable for paying the tax in relation to the supply of such goods or services or both.

(4) The central tax in respect of the supply of taxable goods or services or both by a supplier, who is not registered, to a registered person shall be paid by such person on reverse charge basis as the recipient and all the provisions of this Act shall apply to such recipient as if he is the person liable for paying the tax in relation to the supply of such goods or services or both.

(5) The Government may, on the recommendations of the Council, by notification, specify categories of services the tax on intra-State supplies of which shall be paid by the electronic commerce operator if such services are supplied through it, and all the provisions of this Act shall apply to such electronic commerce operator as if he is the supplier liable for paying the tax in relation to the supply of such services:

Provided that where an electronic commerce operator does not have a physical presence in the taxable territory, any person representing such electronic commerce operator for any purpose in the taxable territory shall be liable to pay tax:

Provided further that where an electronic commerce operator does not have a physical presence in the taxable territory and also he does not have a representative in the said territory, such electronic commerce operator shall appoint a person in the taxable territory for the purpose of paying tax and such person shall be liable to pay tax.

Provided that the integrated tax on goods imported into India shall be levied and collected in accordance with the provisions of section 3 of the Customs Tariff Act, 1975 on the value as determined under the said Act at the point when duties of customs are levied on the said goods under section 12 of the Customs Act, 1962.

(2) The integrated tax on the supply of petroleum crude, high speed diesel, motor spirit (commonly known as petrol), natural gas and aviation turbine fuel shall be levied with effect from such date as may be notified by the Government on the recommendations of the Council.

(3) The Government may, on the recommendations of the Council, by notification, specify categories of supply of goods or services or both, the tax on which shall be paid on reverse charge basis by the recipient of such goods or services or both and all the provisions of this Act shall apply to such recipient as if he is the person liable for paying the tax in relation to the supply of such goods or services or both.

(4) The integrated tax in respect of the supply of taxable goods or services or both by a supplier, who is not registered, to a registered person shall be paid by such person on reverse charge basis as the recipient and all the provisions of this Act shall apply to such recipient as if he is the person liable for paying the tax in relation to the supply of such goods or services or both.

(5) The Government may, on the recommendations of the Council, by notification, specify categories of services, the tax on inter-State supplies of which shall be paid by the electronic commerce operator if such services are supplied through it, and all the provisions of this Act shall apply to such electronic commerce operator as if he is the supplier liable for paying the tax in relation to the supply of such services:

Provided that where an electronic commerce operator does not have a physical presence in the taxable territory, any person representing such electronic commerce operator for any purpose in the taxable territory shall be liable to pay tax:

Provided further that where an electronic commerce operator does not have a physical presence in the taxable territory and also does not have a representative in the said territory, such electronic commerce operator shall appoint a person in the taxable territory for the purpose of paying tax and such person shall be liable to pay tax.

a.) one per cent. of the turnover in State or turnover in Union territory in case of a manufacturer,

Section of IGST Act

Section 5 : Levy and Collection

Section 9 of CGST Act 2017. Levy and collection.

(1) Subject to the provisions of sub-section (2), there shall be levied a tax called the central goods and services tax on all intra-State supplies of goods or services or both, except on the supply of alcoholic liquor for human consumption, on the value determined under section 15 and at such rates, not exceeding twenty per cent., as may be notified by the Government on the recommendations of the Council and collected in such manner as may be prescribed and shall be paid by the taxable person.

(CGST = on all Intra state Supply

Except Alcoholic, Liquor for human Consumption

on Value according to section 15,

Rate < 20%

as notified by GST Council paid By taxable Person)

(2) The central tax on the supply of petroleum crude, high speed diesel, motor spirit (commonly known as petrol), natural gas and aviation turbine fuel shall be levied with effect from such date as may be notified by the Government on the recommendations of the Council.

(3) The Government may, on the recommendations of the Council, by notification, specify categories of supply of goods or services or both, the tax on which shall be paid on reverse charge basis by the recipient of such goods or services or both and all the provisions of this Act shall apply to such recipient as if he is the person liable for paying the tax in relation to the supply of such goods or services or both.

(Reverse Charge Basic

Recipient Pay Tax notification by GST Council)

(4) The central tax in respect of the supply of taxable goods or services or both by a supplier, who is not registered, to a registered person shall be paid by such person on reverse charge basis as the recipient and all the provisions of this Act shall apply to such recipient as if he is the person liable for paying the tax in relation to the supply of such goods or services or both.

(Reverse Charge Basic on

Supply Unregistered to Register Person

6th august 2018 - Notification 22/2018 9(4) Refer till 30/09/2019)

(5) The Government may, on the recommendations of the Council, by notification, specify categories of services the tax on intra-State supplies of which shall be paid by the electronic commerce operator if such services are supplied through it, and all the provisions of this Act shall apply to such electronic commerce operator as if he is the supplier liable for paying the tax in relation to the supply of such services:

Section 2(44) Electronic Commerce

Section 2(45) Electronic Commerce Operator

Section 52 TDS

Provided that where an electronic commerce operator does not have a physical presence in the taxable territory, any person representing such electronic commerce operator for any purpose in the taxable territory shall be liable to pay tax:

Provided further that where an electronic commerce operator does not have a physical presence in the taxable territory and also he does not have a representative in the said territory, such electronic commerce operator shall appoint a person in the taxable territory for the purpose of paying tax and such person shall be liable to pay tax.

Section 5 of IGST act 2017- Levy and collection.

(1) Subject to the provisions of sub-section (2), there shall be levied a tax called the integrated goods and services tax on all inter-State supplies of goods or services or both, except on the supply of alcoholic liquor for human consumption, on the value determined under section 15 of the Central Goods and Services Tax Act and at such rates, not exceeding forty per cent., as may be notified by the Government on the recommendations of the Council and collected in such manner as may be prescribed and shall be paid by the taxable person:Provided that the integrated tax on goods imported into India shall be levied and collected in accordance with the provisions of section 3 of the Customs Tariff Act, 1975 on the value as determined under the said Act at the point when duties of customs are levied on the said goods under section 12 of the Customs Act, 1962.

(2) The integrated tax on the supply of petroleum crude, high speed diesel, motor spirit (commonly known as petrol), natural gas and aviation turbine fuel shall be levied with effect from such date as may be notified by the Government on the recommendations of the Council.

(3) The Government may, on the recommendations of the Council, by notification, specify categories of supply of goods or services or both, the tax on which shall be paid on reverse charge basis by the recipient of such goods or services or both and all the provisions of this Act shall apply to such recipient as if he is the person liable for paying the tax in relation to the supply of such goods or services or both.

(4) The integrated tax in respect of the supply of taxable goods or services or both by a supplier, who is not registered, to a registered person shall be paid by such person on reverse charge basis as the recipient and all the provisions of this Act shall apply to such recipient as if he is the person liable for paying the tax in relation to the supply of such goods or services or both.

(5) The Government may, on the recommendations of the Council, by notification, specify categories of services, the tax on inter-State supplies of which shall be paid by the electronic commerce operator if such services are supplied through it, and all the provisions of this Act shall apply to such electronic commerce operator as if he is the supplier liable for paying the tax in relation to the supply of such services:

Provided that where an electronic commerce operator does not have a physical presence in the taxable territory, any person representing such electronic commerce operator for any purpose in the taxable territory shall be liable to pay tax:

Provided further that where an electronic commerce operator does not have a physical presence in the taxable territory and also does not have a representative in the said territory, such electronic commerce operator shall appoint a person in the taxable territory for the purpose of paying tax and such person shall be liable to pay tax.

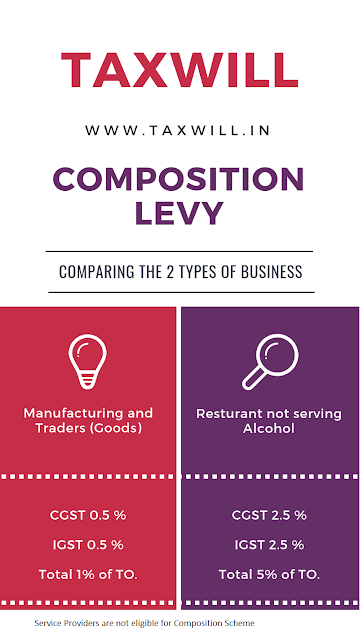

Composition Levy (Section 10 of CGST Act )

10. Composition levy.

(1) Notwithstanding anything to the contrary contained in this Act but subject to the provisions of sub-sections (3) and (4) of section 9, a registered person, whose aggregate turnover in the preceding financial year did not exceed fifty lakh rupees, may opt to pay, in lieu of the tax payable by him, an amount calculated at such rate as may be prescribed, but not exceeding,––

Composition Levy Last Year TO<50 lakh

1% of TO if manufacture

b.) two and a half per cent. of the turnover in State or turnover in Union territory in case of persons engaged in making supplies referred to in clause (b) of paragraph 6 of Schedule II, and

If Schedule II Para 6 (b) - 2.5 % of TO

c.) half per cent. of the turnover in State or turnover in Union territory in case of other suppliers, subject to such conditions and restrictions as may be prescribed:

1/2 of TO if supply is Subject of such Condition and Restricted

Provided that the Government may, by notification, increase the said limit of fifty lakh rupees to such higher amount, not exceeding one crore rupees, as may be recommended by the Council.

50 lakh may increase by notification

23 GST council Meeting

The main threshold for composition scheme was recommended for an increase to Rs. 1.5 crore (from earlier 1 crore). But this is yet to be notified

23 GST council Meeting

The main threshold for composition scheme was recommended for an increase to Rs. 1.5 crore (from earlier 1 crore). But this is yet to be notified

(2) The registered person shall be eligible to opt under sub-section (1), if:—

(If Composition Scheme)

a.) he is not engaged in the supply of services other than supplies referred to in clause (b) of paragraph 6 of Schedule II;

b.) he is not engaged in making any supply of goods which are not leviable to tax under this Act;

c.) he is not engaged in making any inter-State outward supplies of goods;

d.) he is not engaged in making any supply of goods through an electronic commerce operator who is required to collect tax at source under section 52; and

e.) he is not a manufacturer of such goods as may be notified by the Government on the recommendations of the Council:

Provided that where more than one registered persons are having the same Permanent Account Number (issued under the Income-tax Act, 1961), the registered person shall not be eligible to opt for the scheme under sub-section (1) unless all such registered persons opt to pay tax under that sub-section.

(3) The option availed of by a registered person under sub-section (1) shall lapse with effect from the day on which his aggregate turnover during a financial year exceeds the limit specified under sub-section (1).

(4) A taxable person to whom the provisions of sub-section (1) apply shall not collect any tax from the recipient on supplies made by him nor shall he be entitled to any credit of input tax.

(5) If the proper officer has reasons to believe that a taxable person has paid tax under sub-section (1) despite not being eligible, such person shall, in addition to any tax that may be payable by him under any other provisions of this Act, be liable to a penalty and the provisions of section 73 or section 74 shall, mutatis mutandis, apply for determination of tax and penalty.

CGST CHAPTER III - LEVY AND COLLECTION OF TAX

Other Links: